Dependence on industrial civilization, and by extension - industrial agriculture, and by extension - petroleum, will lead us to a definite "die-back" scenario. That is just the logical conclusion of a wild pendulum swing which saw populations explode as petroleum consumption rates exploded, and were used to maximize the wealth of a few and maximize growth for growth's sake. It was our religion and our god is an idol and we worship ourselves to our detriment.

When a guy like Matt Simmons, CEO of multi-billion dollar energy finance group Simmons International, warns of collapsing civilization, we might want to pay attention because he has a lot more to lose than most of us do.

The below article is a clash of very different ideologies. We have the analysts, who look at facts and then we have the manipulator employed by the US government and is probably, (I assume without any facts to support me), a member of a globalist secret society bent upon world-domination of the cloth that authored the infamous PNAC document.

There are 3 players:

1. Dr Edward N Luttwak is a military and national security expert and CSIS claims to provide world leaders with strategic insights on — and policy solutions to — current and emerging global issues.

2. Professor Kjell Aleklet is a Professor at Uppsala University in Sweden and President of ASPO, Association for the Study of Peak Oil and Gas, founded by Colin Campbel, Geologist from Ireland.

3. Matt Simmons is former Energy Advisor to Bush II and CEO of Simmons International, a multi-billion dollar energy investment company.

Two of the above players sit on the same side of the table. One sits on the wrong side.

Dr. Edward is sitting on the side of “forever growth”. His opinion is prevalent, at least publicly, in today’s Bush Administration and in the world.

Which side is right? Is the worldview right or is there a clearer and even opposite and even obvious reality that most fail to see?

Let's try to decide which camp has it right.

=============================

... Quote:

Dr Edward N Luttwak (EL) - The third reason is economic. The Saudis remember when oil sold for $12 a barrel or less. They fear that if they add capacity faster than their present very slow rate, the price will collapse again. So they will only invest in 2-3 million barrels per day of new capacity over the next five years - and that’s nothing like as much as the US hopes for. But even if the Saudis won’t play ball, the good news is that the price of oil is more likely to decline than to increase over the next five years.

Professor Kjell Aleklet (KA): This is an interesting statement. Even if nothing is done that is needed it doesn’t matter, as the price will decline anyhow. A lot of people seriously question this now, including NYMEX traders.

EL - It is easy to assume that today’s high oil price is caused by current market factors: a lack of big new oil discoveries and the loss of Iraqi output, combined with increased demand from medium-growth America and high-growth China and India. But in reality today's $61 oil price is chiefly a reaction to the low oil prices of the past 20 years.

KA: It looks as the price today is OK as it has been too low before. Fantastic statement.

EL - Cheap oil reduced investment in new, higher-cost production capacity which would have exploited deeper offshore oil, heavy oil and tar sands. It reduced investment in long-range pipelines and shipping to exploit remote natural gas finds. It reduced investment in other energy sources such as nuclear and coal, and in energy conservation. At the same time, it increased energy consumption - thanks to America's ubiquitous SUVs, faster ships and larger commercial aircraft fleets. High oil prices should reverse all these trends. This will happen quite quickly in greater use of coal, more gas transportation capacity and more oil production from high-cost sources.

EL - Some changes - including improved energy conservation - will come slowly. Others, especially the increase in nuclear capacity, will come very slowly indeed.

EL - Nevertheless, logic and experience tell us that - in spite of added demand, uncertain reserves and Saudi unwillingness to help - today's $61 oil will itself be the chief cause of a fall in the oil price to come. Expect to see it return to $40, then $30 - and maybe even less.

KA: At the end of the article we get the reason why Dr Luttwak has written this article, he likes to say “Don’t worry, be happy”. He has not convinced me at all. Now it is up to you to make up your own mind, but before you do that you should take the time to read what Matt Simmons has to say here about the article.

KA: On February 24, 2004 — Matthew Simmons, president of Simmons and Company International, and two Saudi Aramco executives, Mahmoud Abdul-Baqi, vice president, exploration, and Nansen Saleri, manager, reservoir management, analyzed the future of Saudi oil production at CSIS.

KA: As Matt Simmons was invited by CSIS, the organization to which Dr Luttwak belongs, to discuss oil production in Saudi Arabia and also recently published a book about the “Twilight in the desert: the coming Saudi oil shock and the world economy”, I asked Mr Simmons if he could read the article and make some comments. This is his replyt:

Matt Simmons (MS): The article is a well written piece that is supported by zero data as the author actually sort of admits. Like many others who love to write and opine on energy issues, he makes clear that Saudi oil reserves are essentially boundless and the only difficulty we will have is their leaders having the will and making the right investment decision to provide access to this oil. But even with his doubts about them ever adding so much oil, the writer can still not conceive that oil prices could ever stay at such ridiculously high prices of over $60 a barrel. Why he thinks $40 is a logical price is also not supported by any factual analysis. All he has in strongly opinionated hunches.

MS - I am sticking to what a modest stack of 235 SPE papers laid out. The age of the Saudi Royal Family is far less important than the age of the five key producing fields. This aging issue will not change, regardless of how high oil prices go. I also think that $65 oil per barrel is extremely cheap with converted to terms humans understand. $.10 a cup for a non-renewable extremely valuable, very capital intensive raw material strikes me as unsustainably low.

MS - Why so many "experts" assumed Middle East oil was so vast and so cheap is a riddle historians writing about the transition into the 21st Century will puzzle for decades. Why we also thought oil should sell for $.02 to $.04 a cup is an even great mystery. Was transparency so bad and knowledge of energy so poor in 2005 that society chopped down the last tree without realizing the tree was the last one around? Is this why society as it existed in the first few years of the 2ist century suddenly collapsed?

MS - The sooner these vague but well written stories cease and people awake to the crisis that is at our door, the faster we put a fire wall between us and what "us" can easily become: a collapsed civilization.

The whole article is here - http://www.peakoil.net/Luttwak.html

=========================

The term “collapsed civilization” coming from a guy like Matt Simmons, ought to wake us up to that very real possibility.

Indeed, if no real substitute for oil and gas is found, then it will be our eventuality. And I highly doubt that a substitute will be found all of a sudden now, as we are clearly on about the peak and trending downwards.

Our wake-up calls keep getting louder, yet marginally few additional people are ready to accept the gravity of threats that exist on the far side of Peak Oil’s slipery slope.

What will it take for mainstream press and politics to address this issue?

Or do they specifically avoid this issue?

Or do a few members of an elite cabal deliberately obfuscate this issue with terrorism in order to consolidate power into a police state prior to coming meltdown of society and industry?

That is a fantastic conspiracy theory, and supported by a load of coincidences too.

Mark Robinowitz seems to have gotten himself lined up along that theory pretty well below...

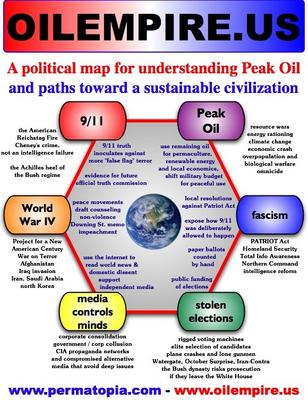

I am compelled to include a few recommendations from diligent and credible authors regarding the site http://www.oilempire.us

While I am not affiliated with the below site in any way, I am always amazed at the number of people that try to discredit an incredible theory just because it seems too incredible to believe.

I urge you, dear reader, to check out this site. Mike Ruppert seems to think the same thing. His recommendation is below the graphic.

Better yet, spend some time in the Oilempire site and see if a light bulb or two isn't revealed for you as well.

"Compelling work by 9/11 investigator Mark Robinowitz adding more knowledge to how the pieces fit together."

-- recommended link "for reason and reliable information" at Michael Ruppert's From the Wilderness publications

"I want to thank a dedicated and meticulous 9/11 researcher named Mark Robinowitz for giving me an analogy about bank robbers"

-- Michael Ruppert,"Crossing the Rubicon: The Decline of the American Empire at the End of the Age of Oil," p. 590, mention of the "9/11 parable" article, a metaphor for understanding 9/11

"Oil Empire is among the best current political websites. 9/11 has been examined by hundreds of writers, some of them quite excellent and others more limited -- but there are still other 9/11 sites whose illogic and rhetorical chicanery suggests disinformation. Oil Empire is by far the best resource for discriminating among the various 9/11 sites, seeking the genuine and avoiding the bogus. The mechanics of 9/11 are important. But the crime remains an isolated incident unless it's framed in a larger narrative of world affairs. This is the great strength of Mark Robinowitz's website."

-- Jamey Hecht, Assistant Managing Editor, From the Wilderness

"The information and analysis on oilempire.us is excellent. As an activist for 9/11 Truth, I've reviewed many websites, and find oilempire.us clear, succinct, well researched, and internally consistent."

-- Emanuel Sferios, Webmaster, 9/11 Visibility Project, http://www.septembereleventh.org

1 comment:

I heard Matt Simmons give a presentation on the oil and gas situation, just prior to hurricane Rita, here in Jackson Wyoming. I left slightly annoyed that he didn't get the economic ramifications of expensive energy. He approached the situation like a typical rich person who planned to float above the crisis because ten dollars a gallon wasn't a big deal to his deep pocketbook. Matt feels that the big oil companies will invest their earnings in a railroad based economy, and everything will be hunky doory. Anyhoo, based on my personal experiance with the man, I would say that he is a beneficiary of being over-rated.

LBP

Post a Comment